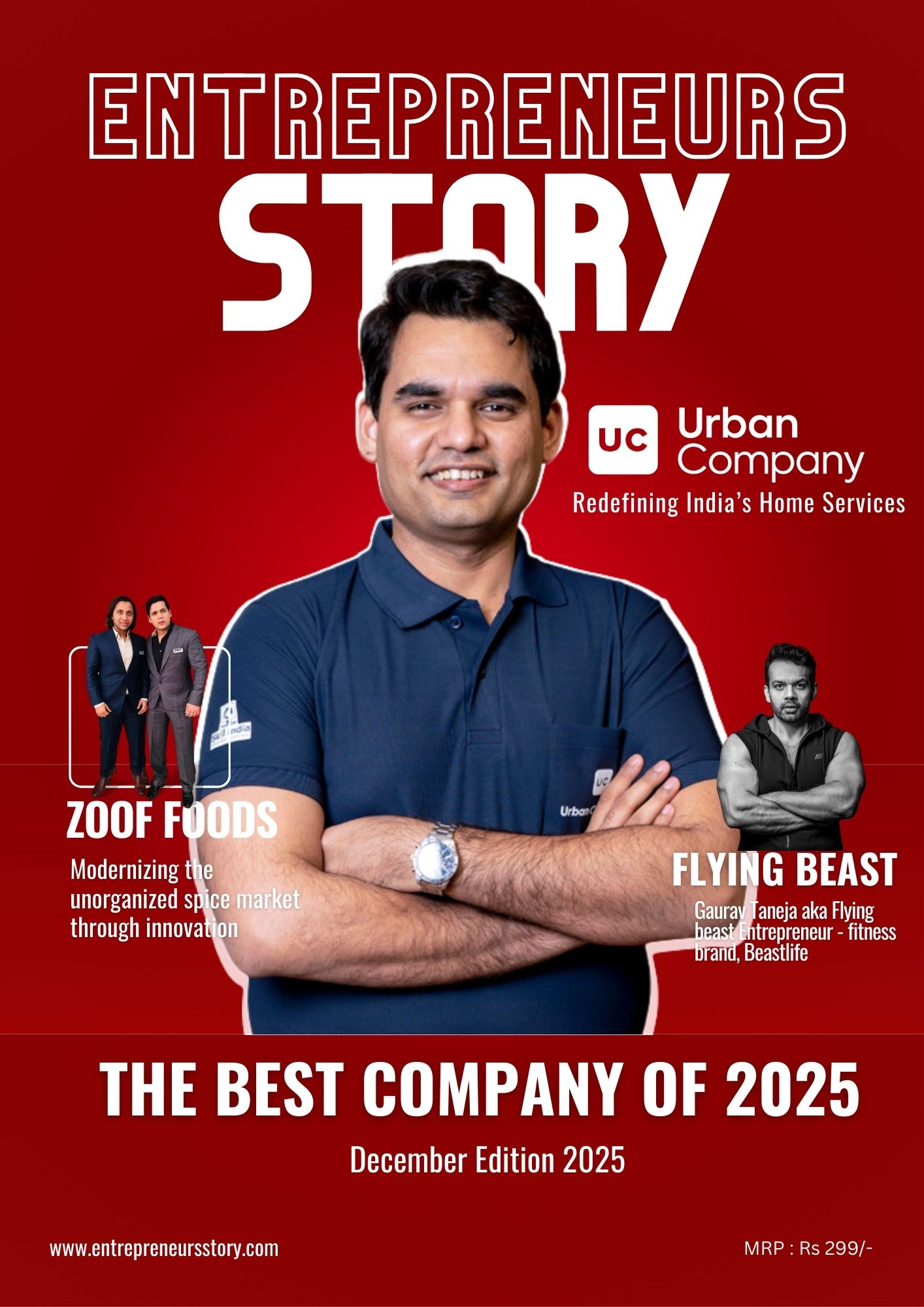

Urban Company beats Aditya Infotech to make the best IPO launchof 2025, with a 57.5% premium

- Industry BSFI New Trending News

- Entrepreneurs Story

- September 17, 2025

- 310

- 8 minutes read

Summary

The shares of Urban Company began trading at Rs. 162.25, a jump of 57.52% premium from the issue cost on the National Stock Exchange. Moreover, intraday, it increased by Rs. 179 that is 73.8% more as compared to the issue cost.

Stock list

The IPO of the Urban Company that had grabbed the attention of Rs. 1.3.63 times subscription, made a handsome IPO listing gain with a finest of higher than 57% over the issue costs of Rs. 103. Furthermore, the stock began trading at Rs. 162.25, an upsurge of 57.52% from the issue costs on the National Stock Exchange. Moreover, intraday, it increased by Rs. 179 that is 73.8% more as compared to the issue cost. Besides the IPO of Urban Company, here is come across other public offers introduced this year with inventory gains of higher as compared to 50%.

Highway Infrastructure

On the NSE, the shares of Highway Infrastructures debuted at Rs. 115 per share which reflects a premium of 64.29% over the IPO issue costs of 70 each unit. Thus, the Rs. 130 crore IPO was considered to be a blend of noel equity shares worth Rs. 97.52 crore and an offer for sale (OFS) of Rs. 32.48 crore. The preliminary sale of share was being subscribed 300.61 times. Here the portion of retail investors was booked Rs. 155.58 times, whereas the non-institutional investors subscribed their part Rs. 447.32 times. Therefore, the group set aside for qualified institutional buyers (QIBs) acquired 420.57 times subscription. Along with this, Highway Infrastructures, originated during 1995, facilitates real estate development services, toll-way collection and EPC.

Aditya Infotech

CP Plus brand operator shares Aditya Infotech listed at Rs. 1,015 apiece on the NSE, a finest of 50.37% over the issue cost of Rs. 675. In addition Rs. 1,300 crore IPO was said to be n unmarked issuance of Rs. 500 crore along with an OFS of 800 crore. Hence, the issue had obtained 100.69 times subscription. The IPO of Aditya Infotech, under the CP Plus brand, serves superior surveillance and video security solutions and goods. Moreover, its products are being utilized within sectors like retail and law enforcement, defence, healthcare, banking, real estate, education, banking, insurance, hospitality and manufacturing industry.

GNG Electronics

Desktops and laptops refurbisher, the shares of GNG Electronics debuted at near about a 50% premium. Hence, on the NSE, it was listed at 355 apiece, which is said to be 49.79% more as compared to the issue costs of Rs. 237.

The Rs. 460.43-crore preliminary public offering that was booked Rs. 147.93 times, comprising of a fresh issuance of shares with a overall OFS of 60.43 crore and 400 crore. The GNG Electronics that operates its business under the Electronics Bazaar brand exist throughout the full refurbishment value chain from sourcing to restoration to sales and after services.

Best IPO launch of 2025 subscription charts

The IPO 2025, of the Urban Company, that opened for command during September 10-12 was subscribed near about Rs. 104 times, by making it the most unsubscribed public issue within India. According to the Indian Stock market, the IPO acquired bids value around market capitalization of Rs. 1.14 lakh crore, with near about 1,106.44 crore shares used against an offer size of Rs. 10.67 crore shares. With this, the issue involved approximately 44.8 lakh applications.

The public offer obtained a stellar reaction from all the three divisions of investors, driven by QIBs, since the part built for them was booked Rs. 140.20 times. The group of non-institutional investors (NII) obtained 74.04 times command, whereas the quota of retail investor was subscribed Rs. 39.25 times. The staff portion observed Rs. 36.79 times subscription.

According to the IPO document, the organization had booked 75% of the IPO for the purpose of QIB, on the other hand, the quota for the retail investors and NIIs was set at 10% and 15%.

In spite of being considered as costly from an assessment stance and stepping into the market before a comparatively muted setting, the IPO of the Urban Company has witnessed robust investor demand. As per Tapse of Mehta Equities, this was mainly driven by NIIs (77x) and QIBs (147x) with the involvement of retail also staying healthy (41x) in comparison with other current offerings.

Based on his perspectives, the strong reaction is well-sustained from a long-lasting investment viewpoint. Currently, the company is only a prearranged player into the tech-driven online home services market, relishing a leadership rank throughout 51 cities within India along with Singapore and the UAE.

It is a robust brand recollects along with a first-mover benefit position it in the form of a favored service facilitator into a leading uneven industry. It is being reported during August that Elevation Capital that wrote the initial seed cheque for the firm previously was planning to take part into the future IPO of the organization as a purchaser, via its recently developed $400-million late-stage Elevation Holdings of vehicle.

The analysts suggested the assigned investors to carry the stock by considering a long-lasting investment viewpoint, by taking into account the intrinsic risks imposed by the market. While, for the non-assigned investors, a wait and watch strategy is highly advisable to evaluate any post-listing dip as a possible stepping aspect.