Introduction

The operating of Zype’s revenue, a Fintech startup, has increased by about 5 times to Rs. 101.3 crore during the financial year ending March 2025. The growth was enhanced through a significant increase in interest profits from its loan portfolio

Core fiscal figures for FY25

- Operating revenue: Maximized at about 5X, from Rs. 20.3 crore during FY24 to Rs. 101.3 crore during FY25.

- Total income: Reached Rs. 106 crore, involving non-processing sources like interest on fixed deposits.

- Interest income: Zype has been operating in the form of an NBFC, serving unsecured personal loans to young salaried professionals for certain events like medical expenditures, home repairs, and weddings. During FY25, the interest income increased almost sixfold to Rs. 62 crore, creating 61% of Zype’s overall revenue.

- Processing fees: Extended fivefold to Rs. 34.39 crore, which accounted for 34% of the organization’s revenue. Expenditures increased by more than three times to Rs. 118.9 crore during FY25, compared to Rs. 35.8 crore during FY24.

- Net loss: Broadened by 76% to Rs. 12.85 crore during FY25, chiefly because of the increasing expenditures.

- Employee benefit expenditures: Employee benefit expenditures accounted for up to 20% of the overall costs, increasing by 89% to Rs. 24 crore during the year FY25. Furthermore, the finance costs on borrowing increased to 19%, up from Rs. 1.6 crore during FY25, whereas the marketing expenditures also increased by Rs. 10 crore during the same year.

Zype has also generated approximately Rs. 4.87 crore through its other operating amenities, which involved penalty charges along with a supplementary amount of Rs. 4.7 crore through non-operating sources like gains on mutual funds, income tax refunds, and fixed deposits. Moreover, this took its overall income to Rs. 106 crore during FY25.

Factors influencing productivity

In spite of the impressive growth in revenue, the productivity of Zype was impacted by numerous factors:

- Maximized expenditures:The total expenses of the organization increased by over 3.3 times.

- Greater write-offs: Awful debits worth Rs. 19 crore were written off.

- Provisioning of loan loss: Zype made supplies of Rs. 7.95 crore for non-performing assets (NPAs).

- Finance costs: These costs on borrowing increased to Rs. 22.6 crore, as compared to Rs. 1.6 crore during the past financial year.

Other significant overheads included verification costs, IT expenditures, professional and legal fees, lease rentals for equipment and office space, as well as other supplementary expenses of another Rs. 35.4 crore.

Therefore, the total expenses for the organization increased by up to 3.3 times to Rs. 118.9 crore during FY25, compared to Rs. 35.8 crore during FY24. This indicates a pivotal shift from Rs. 200 crore disbursals during FY24, which reflected Zype’s adept navigation of a post-pandemic recognition scenery.

Data on Zype’s unit level

It can be said that at a unit level, the company spent approximately Rs. 1.17 in order to earn one rupee of operating revenue during FY25. Moreover, as of March 2025, the organization’s present assets stood at Rs. 368.7 crore, which included bank and cash balances of Rs. 33.65 crore.

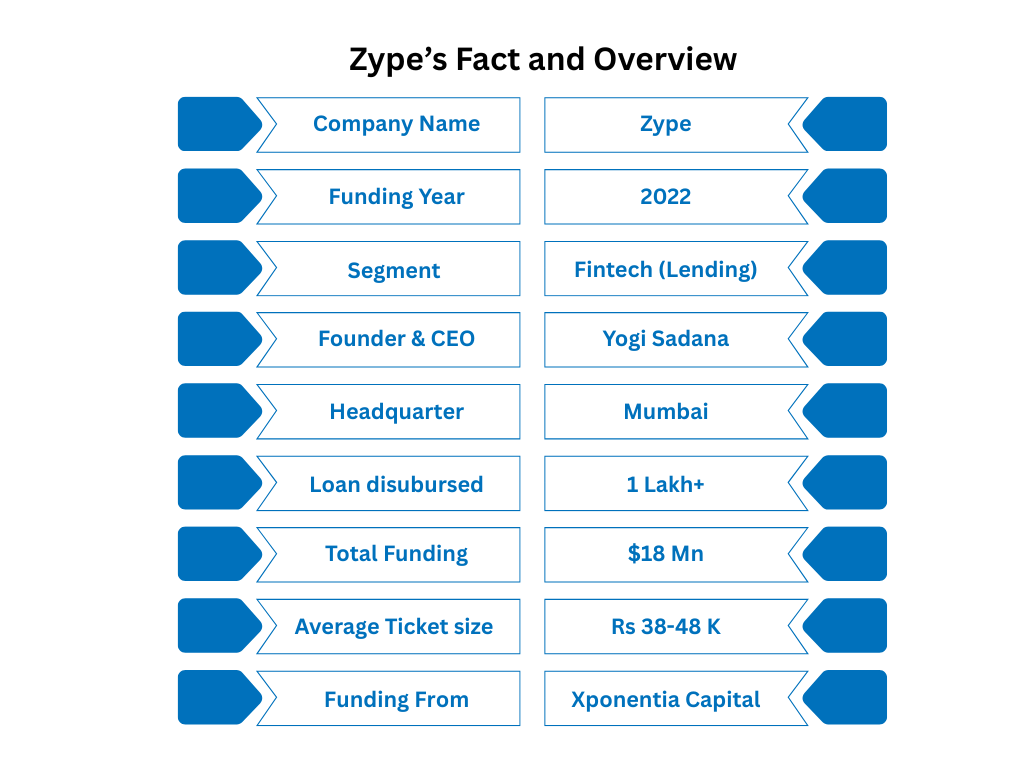

According to reports, the Mumbai-based company raised around $30 million, which involved its Rs. 90 crore ($10.2 million) round led by Unleash Capital Partners, a Japanese venture capital organization, with participation from current shareholder Xponentia Capital.

Growth of Zype

- Established in 2022 by Yogi Sadana, the fintech veteran, the former CEO of Cashe, the lending app, and backed by Ajay Relan, the serial entrepreneur, the company burst onto the scene with a profound and simple vision: democratize access to unsecured and instant personal loans for young professionals who are earning Rs. 15,000 to Rs. 50,000 monthly.

- Processing the business as a full-stack non-banking financial company (NBFC), after securing its license in 2023, the company has rapidly emerged from a fledgling startup to an assessment behemoth at Rs. 4.5 crore.

- Moreover, its FY25 performance is not just numbers on a balance sheet; rather, it is considered to be a description of flexibility among financial headwinds, which involved authoritarian inspection on digital lenders and lasting inflation burden.

Zype’s perspective

We are lending hope, rather than just lending money, said Sadana during a private interview with a reporter. He said that their users are not card elites within metros; instead, they are sales representatives in Jaipur, engineers in Coimbatore, and teachers in Lucknow who require Rs. 20,000 for an emergency medical bill or a family wedding. During FY25, the company empowered approximately 3 million such borrowers, which is just the beginning.

Tactical funding exercises

The company’s financial bombardment occurs on the path of tactical funding practices, which supercharged its expansion. Moreover, in August 2025, the company clinched a Rs. 90 crore Series B round, which followed the Rs. 146 crore Series A round in 2023, driving in stability.

In addition, the infusion brings an overall equity increase of Rs. 236 crore, allowing for hires into tech research and development, as well as risk underwriting, along with forays into micro-insurance and bill payments.

Thus, stakeholders view the company as a Category A player in the Rs. 2 lakh crore personal loan market.

Future trajectory

- The sector, which was valued at $50 billion in 2025, is expected to reach $150 billion by the end of 2030, driven by 900 million burgeoning middle-class and internet users.

- Rivals such as KreditBee and Fibe, both unicorns, control the market with revenues of over Rs. 5,000 crore, but Zype distinguishes itself through hyper-personalization, offering loans tailored to various events or educational needs.

- The foray of Zype into the entrenched finance, incorporating loans into e-commerce checkouts, is suspended to include Rs. 50 crore into its subsidiary revenue in the future financial year.